Corporate Voluntary Agreement (CVA): Meaning and Business Applications.

Corporate Voluntary Agreement (CVA): Meaning and Business Applications.

Blog Article

Ultimate Overview to Comprehending Business Volunteer Agreements and How They Profit Organizations

Corporate Voluntary Agreements (CVAs) have actually come to be a tactical tool for businesses looking to browse economic obstacles and reorganize their procedures. As the service landscape proceeds to progress, understanding the ins and outs of CVAs and just how they can favorably impact firms is important for educated decision-making.

Comprehending Corporate Voluntary Arrangements

In the world of business administration, a basic principle that plays a pivotal role fit the partnership in between stakeholders and firms is the elaborate mechanism of Business Voluntary Agreements. These contracts are voluntary dedications made by business to abide by particular requirements, practices, or objectives past what is lawfully needed. By getting in into Business Volunteer Arrangements, firms demonstrate their dedication to social obligation, sustainability, and honest business practices.

Advantages of Corporate Voluntary Contracts

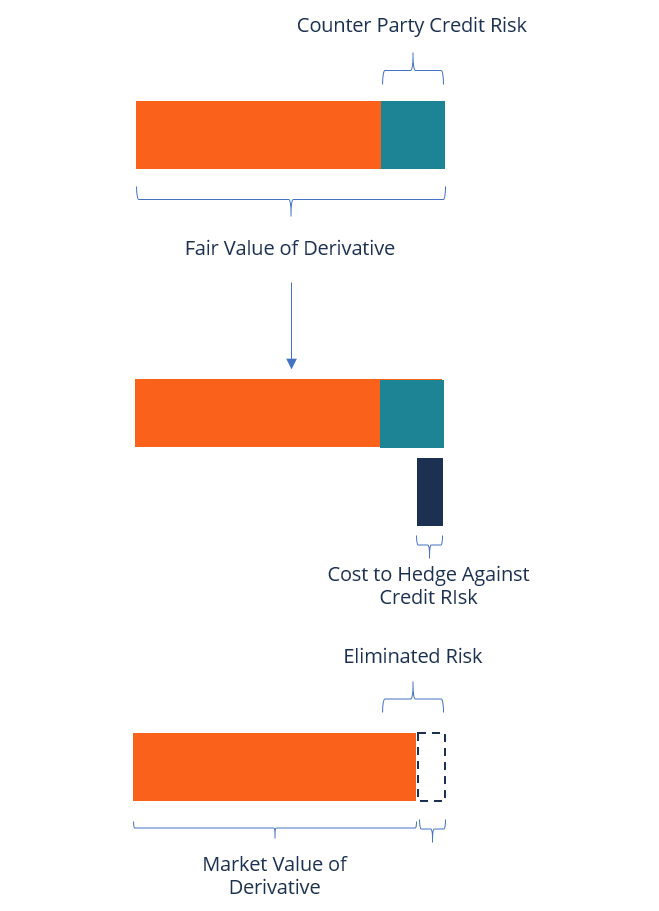

Moving from an expedition of Business Volunteer Arrangements' significance, we currently transform our interest to the tangible advantages these arrangements provide to firms and their stakeholders. Among the main benefits of Business Volunteer Arrangements is the chance for firms to restructure their debts in a more convenient way. This can help minimize financial burdens and avoid possible insolvency, enabling business to proceed running and possibly prosper. In addition, these arrangements give a structured framework for arrangements with lenders, fostering open interaction and cooperation to reach equally advantageous solutions.

Moreover, Corporate Volunteer Arrangements can enhance the firm's credibility and partnerships with stakeholders by demonstrating a commitment to resolving economic challenges properly. Generally, Corporate Volunteer Arrangements serve as a strategic tool for business to navigate monetary hurdles while maintaining their operations and connections.

Refine of Applying CVAs

Understanding the process of applying Business Voluntary Contracts is important for companies seeking to navigate financial difficulties efficiently and sustainably. The first step in carrying out a CVA includes assigning a qualified insolvency professional who will work closely with the firm to assess its financial scenario and stability. Throughout the application procedure, routine interaction with lenders and attentive economic management are key to the successful execution of the CVA and the company's ultimate monetary recuperation.

Secret Considerations for Organizations

When examining Corporate Voluntary Contracts, organizations must meticulously think about vital aspects to make certain successful economic restructuring. One essential factor to consider is the sustainability of the suggested payment plan. It is crucial for organizations to analyze their capital forecasts and make sure that they can meet the agreed-upon repayments without threatening their procedures. Furthermore, companies should thoroughly evaluate their existing financial debt framework and examine the impact of the CVA on numerous stakeholders, including providers, employees, and creditors.

One more essential consideration is the degree of transparency and interaction throughout the CVA process. Open and straightforward communication with all stakeholders is crucial for developing count on and making certain a smooth execution of the agreement. Organizations should also think about seeking specialist advice from lawful professionals or economic experts to browse the complexities of the CVA process properly.

In addition, companies need to evaluate the lasting ramifications of the CVA on their track record and future financing chances. While a CVA can supply immediate relief, it is important to examine how it might influence connections with lenders and investors in the lengthy run. By thoroughly taking into consideration these crucial aspects, services can make educated decisions pertaining to Business Volunteer Contracts and set themselves up for an effective economic turn-around.

Success Stories of CVAs in Activity

A number of companies have successfully implemented Company Voluntary Agreements, showcasing the effectiveness of this monetary restructuring device in renewing their procedures. One remarkable success story is that of Firm X, a having a hard time retail chain encountering insolvency because of mounting debts and declining sales. By participating in a CVA, Business X had the ability to renegotiate lease agreements with property owners, lower overhead prices, and restructure its financial debt obligations. Therefore, the company had the ability to maintain its monetary setting, boost capital, and avoid bankruptcy. More Bonuses

In an additional instance, Business Y, a manufacturing company strained with legacy pension plan liabilities, used a CVA to reorganize its pension commitments and simplify its operations. Through the CVA procedure, Business Y achieved significant price financial savings, boosted its competition, and protected long-lasting sustainability.

These success stories highlight exactly how Company Volunteer Arrangements can supply having a hard time businesses with a practical path in the direction of economic recuperation and functional turnaround - what is a cva agreement?. By proactively addressing monetary difficulties and reorganizing commitments, companies can emerge stronger, a lot more agile, and better positioned for future development

Final Thought

In final thought, Company Voluntary Arrangements offer organizations an organized strategy to resolving economic difficulties and reorganizing financial obligations. By applying CVAs, companies can avoid insolvency, safeguard their properties, and preserve relationships with lenders.

In the realm of corporate administration, an essential idea that plays a critical role in shaping the partnership between stakeholders and firms is the elaborate system of Company Voluntary Agreements. By entering into Business Volunteer Arrangements, business show their dedication to social responsibility, sustainability, and moral company practices.

Moving from an expedition of Corporate Voluntary Arrangements' significance, we currently turn our focus to the substantial benefits these agreements use to business and their stakeholders.In Addition, Business Voluntary Arrangements can enhance the business's credibility and connections with stakeholders by showing a dedication to attending to financial challenges properly.Comprehending the process of recommended you read implementing Business Voluntary Arrangements is crucial for firms seeking to browse financial challenges click site properly and sustainably.

Report this page